6 Best Accounting Software for a Small Business in 2024

[EXPERT REVIEWS]

Accounting can seem daunting when you have no experience with it. Fortunately, there’re solutions that can get you started quickly and hassle-free. We’ve compiled a list of the best accounting software for a small business to help you find the most suitable one for your needs.

Keep scrolling if that sounds like what you’re looking for.

Published: June 30, 2022

Top Accounting Software for Small Businesses in 2024

1. ZarMoney

ZarMoney is one of the leading web-based accounting solutions. Its comprehensive offering provides everything a small business might need. Full Review

- Seamless invoicing and billing

- Bank synchronizations

- Automated tax calculation and payment

ZarMoney is one of the leading web-based accounting solutions. Its comprehensive offering provides everything a small business might need. Full Review

2. QuickBooks

QuickBooks can considerably simplify your accounting. It will help you stay organized and keep your books accurate and in sync with your bank and favorite apps. Full Review

- Bills management

- Expenses and invoicing

- Inventory and 1099s for contractors

QuickBooks can considerably simplify your accounting. It will help you stay organized and keep your books accurate and in sync with your bank and favorite apps. Full Review

3. Quaderno

Quaderno is a global tax specialist and one of the best small business accountants. Its e-commerce integrations will assure your tax compliance worldwide. Full Review

- E-commerce integrations

- Tax metrics tracking

- Instant tax reports

Quaderno is a global tax specialist and one of the best small business accountants. Its e-commerce integrations will assure your tax compliance worldwide. Full Review

4. Zoho Books

This tool is Zoho’s take on handling business accounting. It deals with many essential accounting concepts, such as receivables, payables, and even keeping track of your most important contacts. It’s an absolute hit for small businesses working in the IT field. Full Review

- Invoices and purchase orders

- Inventory tracking

- Time tracking with multiple-project support

This tool is Zoho’s take on handling business accounting. It deals with many essential accounting concepts, such as receivables, payables, and even keeping track of your most important contacts. It’s an absolute hit for small businesses working in the IT field. Full Review

5. TruPoint

Due to its simplicity, TruPoint is a good solution for beginners. Its customer support and a dedicated team of experts are also available to train and guide you. Full Review

- Yearly financial statement compilation

- Tax filing

- Royalties and rights

Due to its simplicity, TruPoint is a good solution for beginners. Its customer support and a dedicated team of experts are also available to train and guide you. Full Review

6. Sage

Sage is one of the best cloud accounting options. It offers the essential set of bookkeeping features along with automation, simple invoicing, and an intuitive interface. Full Review

- Automated invoicing and expense tracking

- Cash flow management dashboard

- Easy Stripe integration

Sage is one of the best cloud accounting options. It offers the essential set of bookkeeping features along with automation, simple invoicing, and an intuitive interface. Full Review

Accounting Solution Companies — Detailed Reviews

- Rating: 10

- Pricing: From $15.00/month

- Customer Support: Via help center, user community, and online form (email)

- Customer Reviews: Excellent

- Tax Management: Yes

- Free Trial: Yes

ZarMoney is a comprehensive accounting solution that can meet the needs of any small business owner. It’s completely cloud-based and supports useful integrations that you can implement into your business.

With this platform, you can create and send your invoices almost instantly by populating the template fields with customer data from your database. Plus, your digital invoices will have a “Pay Now” link that your customers can use to pay directly from the invoice.

ZarMoney effectively simplifies your billing management and recurring payments. It also provides automatic bank integration and advanced inventory management.

Furthermore, other features that make ZarMoney a great enterprise accounting software are the easy generation of printable quotes for your customers, automated sales tax calculation, multiple user access support, and bank account reconciliation.

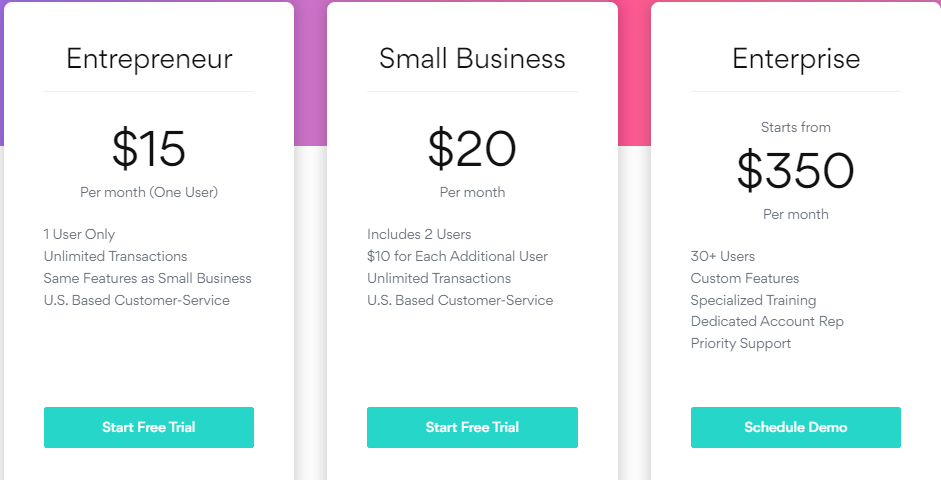

As far as pricing is concerned, ZarMoney is available in three tiers, ranging between $15.00 and $350.00 per month. Keep in mind that the price of your subscription will increase as you add more users from your company.

| Pros | Cons |

| Easy to set up and use | Navigation could be more centralized |

| Customizable quotes and invoices | It may not integrate with every bank |

| Secure bank setup | |

| High-quality customer service |

- Rating: 9.9

- Pricing: From $17.50/month

- Customer Support: Via help center, user community, and phone

- Customer Reviews: Excellent

- Tax Management: Yes

- Free Trial: Yes

QuickBooks is another popular solution that offers accounting for small business owners. It will simplify your bookkeeping. That’s why QuickBooks Live is one of the best online bookkeeping services today.

It also helps you oversee and manage many accounting needs of your business. You can even organize all of your bills online to make sure they’re paid on time, and you can create professional-looking invoices for free.

In addition, you can keep track of your inventory, knowing what’s in stock in real-time. QuickBooks also helps you monitor back orders and notifies you with low-stock alerts.

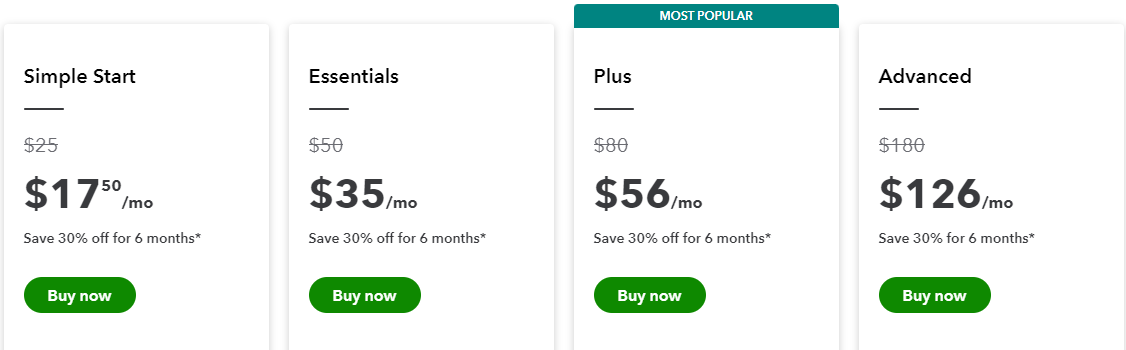

If you’re a small business, QuickBooks is worth looking into. There are four plans, ranging from $17.50 to $126.00 per month, so the tool offers good flexibility in terms of prices that can match your needs and the size of your business.

| Pros | Cons |

| Customizable reports | Some customers reported issues with payments |

| Easy accounting and reporting | Customer support could be improved |

| Good bank reconciliation | |

| Client and vendor management |

- Rating: 9.8

- Pricing: From €29.00/month

- Customer Support: Via help center and email (online form)

- Customer Reviews: Excellent

- Tax Management: Yes

- Free Trial: Yes

When evaluating finance software, the ability to deal with tax compliance is of vital importance, and Quaderno is one of the leaders in this category.

A simple yet powerful tax management tool that can automate your business’s compliance, Quaderno is primarily designed to optimize your processes when dealing with sales tax.

The software integrates seamlessly into your existing system and performs well with many leading e-commerce platforms, such as Amazon, Shopify, and WooCommerce, which collectively had a market value of $26.7 trillion in 2021.

It also works well with payment processors, such as PayPal, which has nearly 500 million users.

Quaderno calculates the appropriate tax rate on every customer transaction by verifying the location of the buyer, applying the accurate tax calculation, and adding it to the transaction at checkout.

The platform provides dashboards that show real-time revenue data and the tax obligations of the business anywhere in the world at any time. Finally, it also generates reports that enable you to file your business tax returns quickly.

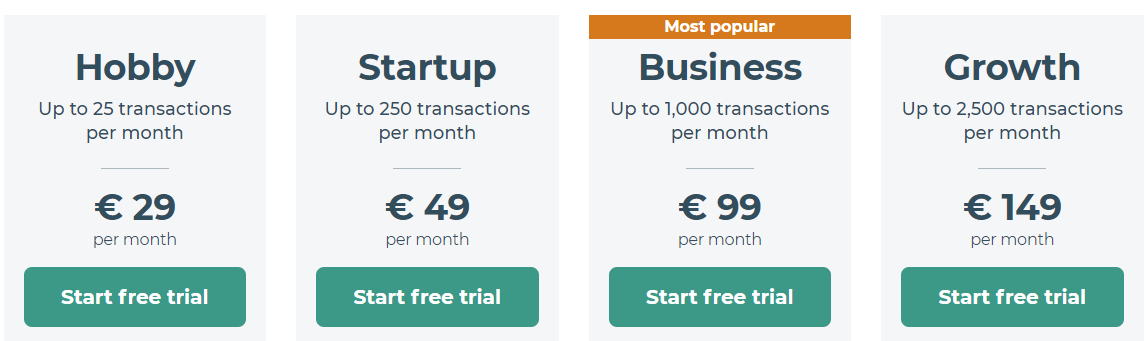

To use this software for accountants, you’ll need to choose between four plans, ranging from €29.00 to €149.00 per month.

| Pros | Cons |

| Easy to set up | Fixing incorrect information can sometimes be difficult |

| Superb customer support | Pricier than some of its alternatives |

| Global sales tax compliance | |

| Stripe and PayPal integrations |

- Rating: 9.8

- Price: From $0.00/month

- Customer Support: Via help center, email, and phone

- Customer Reviews: Excellent

- Tax Management: Yes

- Tax Management: Yes

Developed by Zoho, a company known for its web-based tools, such as cheap website builders, task management software, etc., Books is the company’s take on professional online accounting software.

It lets its users manage finances, automate workflows, and collaborate across different departments that comprise an average small business in tech.

It’s a tool that allows smooth end-to-end accounting and collaborative role-based access. You can create invoices and payment reminders, generate and send purchase orders, upload expense receipts, and keep track of all payments.

As with any good accounting software for a small business, Zoho Books lets you monitor your inventory at all times, import your bank statements to your accounting software, manage multiple projects, and track the time spent on each one.

You can also keep, edit, and manage all of your contacts in one place. Plus, the software offers over 50 different business reports that you can schedule or generate when needed.

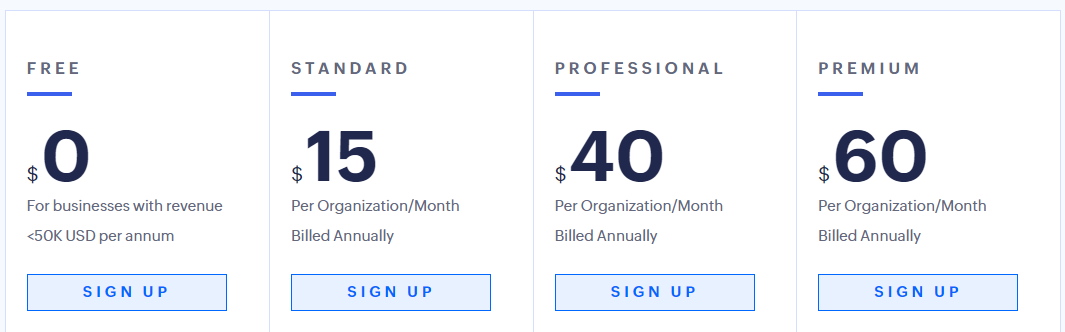

As far as prices go, Zoho Books offers three paid plans, ranging from $15.00 to $60.00 per month.

| Pros | Cons |

| Intuitive UI | Not all banks are supported |

| Simple billing management | Lack of customization |

| Powerful mobile apps | |

| Well-implemented bank reconciliation |

- Rating: 9.7

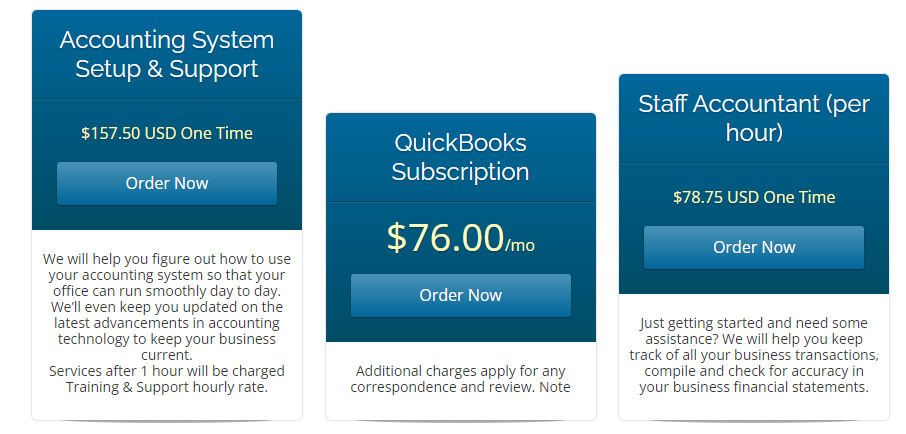

- Price: From $76.00/month

- Customer Support: Via live chat, phone, and email

- Customer Reviews: Excellent

- Tax Management: Yes

- Free Trial: No

TruPoint offers accounting, tax filing, payroll, and even business development, all through a simplified design.

You can do monthly, quarterly, and yearly bookkeeping, keep track of all your business transactions, import your bank statements, and prepare your financial statements.

If you’re just starting out, TruPoint will help you set up your bookkeeping system so everything can run smoothly from the get-go.

At the end of the year, TruPoint generates a customized Financial Package organized in a way that will help you file your taxes easier. This option is free for yearly bookkeeping clients.

Another great feature of this online-based accounting software is the availability of an expert team ready to help and even train you on how to do your bookkeeping.

Trupoint’s pricing differs according to the specific accounting service you want to obtain. For example, a QuickBooks subscription is $76.00/month. If you want to hire an accountant, it’s for $78.75/hour.

If you want a full accounting setup and support, it’s $157.50 for a one-time payment, and so on.

| Pros | Cons |

| Simplified UI | Some may consider the features somewhat limited |

| Top-notch customer support | No mobile apps |

| Expert help and education | |

| Fast cash deposit |

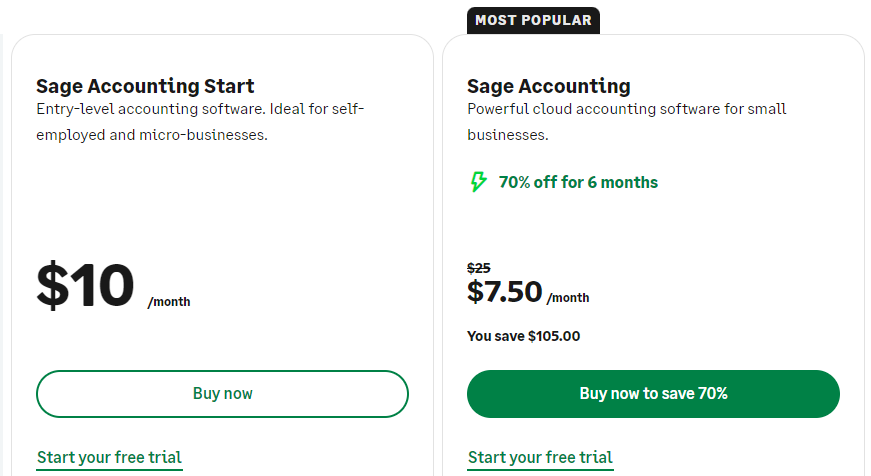

- Rating: 9.8

- Price: From $10.00/month

- Customer Support: Via resource center, user community, phone, and online form

- Customer Reviews: Above average

- Tax Management: Yes

- Free Trial: Yes

Sage is another great pick among the top accounting software for small business owners. It offers all the essential bookkeeping features through a simplified setup, which makes it a great solution for smaller businesses. Its UI is highly intuitive and fast-loading.

As a solid accounting software, Sage can also help you keep your tax compliance in check at any time, which significantly reduces the risk of having any back taxes to worry about.

The platform will manage and track your invoices, help you get paid on time, and keep your cash flow in check. Creating, sending, and tracking invoices is automatic, which will save you a lot of work.

Stripe integration is another useful feature that makes getting paid through it easier and more secure. Additionally, you can connect your bank account and track all expenses directly.

You can save time by snapping and posting invoices and receipts with AutoEntry. That can help you stay up-to-date with all your accounts in real-time through a powerful user dashboard.

To use this cloud accounting software, you have to choose one of two plans, which cost $10.00 and $25.00 a month, making this service one of the most affordable ones on our list.

| Pros | Cons |

| Easy to set up and maintain | Bank synchronization can be slow sometimes |

| Responsive customer support | The community forum is less robust than that of some competitors |

| Powerful invoicing functionality | |

| Extensive catalog of features |

How to Choose the Best Accounting Software for a Small Business

There are several main factors you should concentrate on when choosing an accounting solution for your small business.

Features

A good accounting solution company is one that offers all the features your business needs in order to perform at its best. So, it’s essential to take a detailed look at the feature list of every product you’re considering.

Furthermore, some software solutions offer a free trial period, which is the best way to test a product and see if it’s a good fit for your business.

Price

As a small business owner, your budget is most likely limited. Comparing your options in terms of their price points is important to see which one would fit your financial resources best.

User Reviews

Consulting user reviews has proven to be among the most helpful practices in online shopping. So we hope that our list of the best accounting software for a small business provides a good first step in confirming whether one of these services is right for you and your business needs.

Verdict

Although accounting may seem like a daunting task at first, there’s no reason to feel intimidated. There are many tools, both web-based and downloadable, that can be of great help when it comes to integrations, automations, bookkeeping, and tax management.

FAQ

What is accounting software?

It’s a computer program or an online tool that maintains accounting books. Its main features are recording and tracking transactions, expenses, and revenues, as well as providing direct bank and e-commerce integrations, some of which include online payment services such as PayPal.

What is the easiest accounting software for a small business?

The answer to this question is highly subjective and depends on your experience and current skill set. However, some platforms such as TruPoint and Zoho Books offer highly intuitive user interfaces that are very helpful if you’re a beginner.

What is the best accounting software for a small business?

Finding the best accounting software for a small business is an endeavor that depends on many factors and conditions specific to you and your company.

Our list features some of the best picks currently available. The best one for you, however, will depend on your needs and budget — though you can’t go wrong with any service provider we listed.